Anna Young-Ferris

SDGs by 2030 – are we on track?

Institutional investors demand a more sustainable capitalism

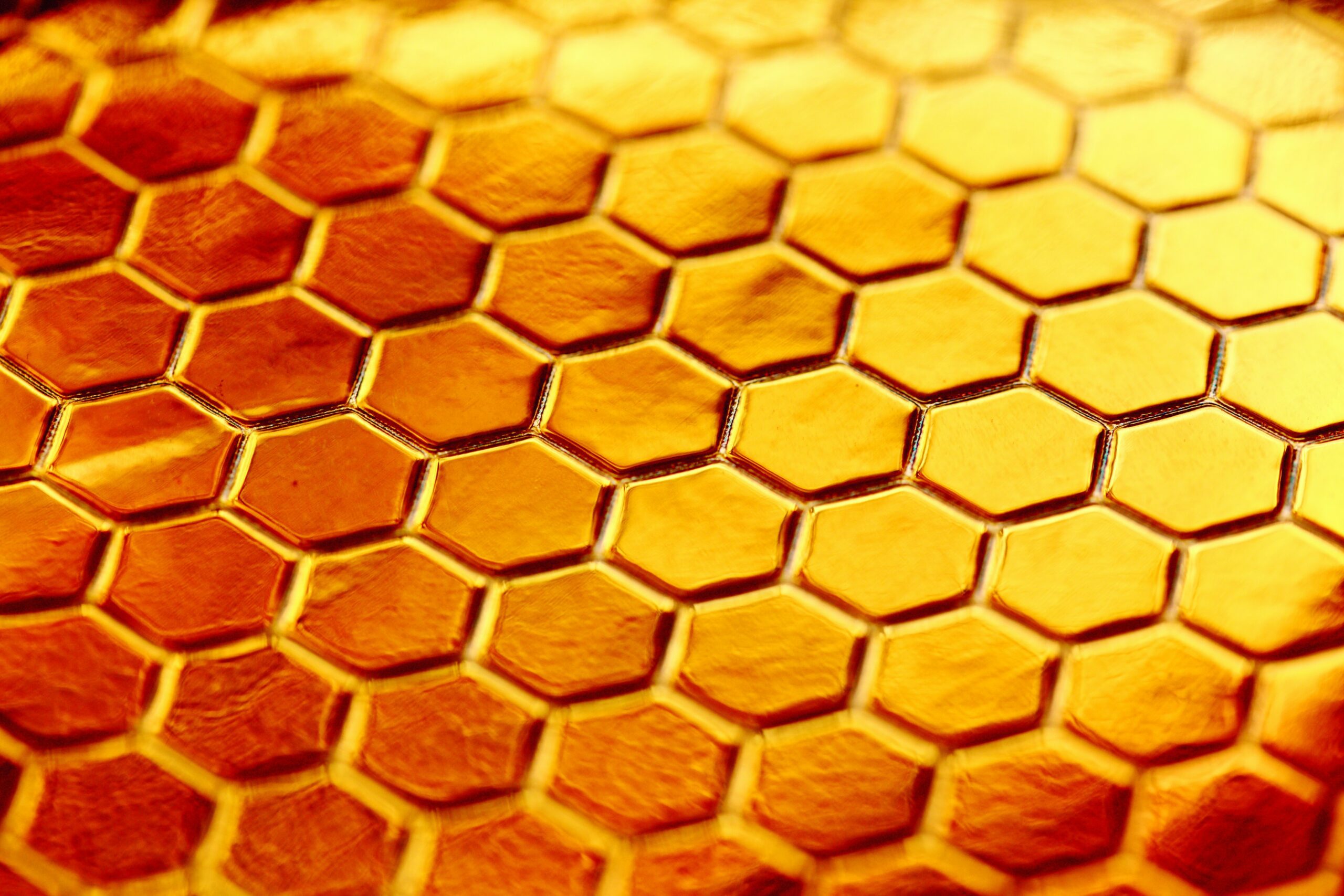

Honey gathering is a solitary job in Indigenous communities. The collector then shares the honey with their community but refrains from joining in the honey feast themself. The idea is that the gathering is not about their gratification, it’s about their contribution to the collective.

Such restraint might seem unnecessarily altruistic to Western eyes. However, it exemplifies the kind of long-term and collective thinking required amidst the escalating climate, biodiversity, and inequality crises across all market economies. How can we say our capitalist institutions and economy are strong when more than half of the world’s population live on less than AUD$10 per day?

In market economies the ‘honey gatherers’ needed to usher in this kind of collective thinking might well be institutional investors. Institutional investors will be one of the major forces behind achieving SDG 16, target 16.6: develop effective, accountable, and transparent institutions at all levels.

Investors choose where they put their money. For publicly listed companies, the investors also vote for the composition of the board of directors, who in turn are responsible for ensuring companies are effective, accountable and transparent.

As my research reveals, investors are increasingly demanding companies integrate environmental, social and governance (ESG) considerations into their decision making, while standard setters and regulators are slowly but surely following. Would you invest in a highly profitable company that used child labour? No, that would be utterly repugnant.

What this tells us is in business, profit does not have to be the only primary signal. ESG impacts are increasingly being construed as sometimes more important than the short-term fluctuations of the stock market. Such investor pressure can change corporate behaviour. Companies that do not uphold the concerns and values of their investors will suffer an outflow of funds.

One foundational concept I challenge in my teaching and research is the notion of shareholder primacy i.e. the relentless pursuit of profit in Western business. Research confirms that investors can act with financial interest and in the best interest of the planet and its people.

Business schools have been complicit in the false narrative around the primacy of the profit motive in business. It is possible to offer a broader view and even perhaps reach outside of traditional Western approaches to consider how we can reframe the relationship of business in society.

A student in our ‘Responsible Business Mindset’ postgraduate course in the University of Sydney Business School told me recently they were thrilled to learn that business does not only have to be about making money. The course challenges the ‘logic’ that profit always has to be the foundational driver of business. It is possible for business to pursue profit in a purposeful way – by providing good jobs, goods and services – without exploiting humans and damaging the environment in the process.

Certainly, when considering the sustainability crisis – it is tempting to fall in with ‘capitalism is broken’ thinking. But improved transparency across the production and consumption value chain process has raised ethical and sustainability concerns (modern slavery, fossil fuels addiction, depleting scarce resources) and investors are increasingly seeking to divest from entire supply chains of companies. It may well be possible to repatriate investment markets, albeit with an interconnected system of more effective, accountable, transparent corporate and government institutions at all levels.

This will take a transformative shift in mindset. Western capitalism has ingrained in us the belief that our individualistic lifestyle is the natural norm. Through education and conditioning, we have been led to think and behave in a highly materialistic manner.

The Indigenous honey gathering story tells us that selfishness is not hardwired into human behaviour. The honey gatherer wants their community to thrive and knows that a different member will be assigned this task the next day, then they will share in the honey feast. It’s about collective benefit. Only a collective and just mindset within the institutions – particularly the investment ones – that form the foundation of capitalism can serve humanity well.

Sustainable Development Goal (SDG) target addressed:

Target 16.6 Develop effective, accountable and transparent institutions at all levels.

Resources

Further reading

Articles

- Kotsantonis, S., Pinney, C., & Serafeim, G. (2016). ESG integration in investment management: Myths and realities. Journal of Applied Corporate Finance, 28(2), 10-16.

- Busch, T., Bauer, R., & Orlitzky, M. (2016). Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact. Organization & Environment, 29(3), 347-368.

Dr Anna Young-Ferris is a Senior Lecturer of Accounting, Governance and Regulation at the University of Sydney Business School at the University of Sydney Business School. One of her scholarly research interests lies in transforming the business education narrative from one of Shareholder Primacy to a more Responsible Business Mindset.

Share

We believe in open and honest access to knowledge.

We use a Creative Commons Attribution NoDerivatives licence for our articles and podcasts, so you can republish them for free, online or in print.