Mapping the money (part 1): The capital landscape for early-stage purpose-driven businesses

May Samali, Director at Tumml and University of Sydney Alumni, provides an in-depth look at how early-stage purpose-driven businesses are raising capital, and highlights the “pioneer gap” they face in their startup phase.

Popularized by business pioneers such as Ben Cohen and Jerry Greenfield of Ben & Jerry’s, Jessica Alba of The Honest Company, and Blake Mycoskie of Toms Shoes, purpose-driven businesses leverage the power of the marketplace to create social, economic and environmental value. In this three-part series, May Samali, Director at Tumml, an urban ventures accelerator in San Francisco, explores the challenges facing early-stage purpose driven businesses. Her first post provides an in-depth look at how these businesses are raising capital, and highlights the “pioneer gap” they face in their startup phase.

Throughout my career, I have witnessed the power of purpose-driven businesses to address pressing challenges such as unemployment and climate change, all while producing financial returns. But I have also noticed that purpose-driven businesses struggle to access funding, especially in their earliest stages of development. For example, I have encountered entrepreneurs who have been strung along by impact investors, only to be turned away after 12 months. I have also heard the complaints of founders who had to pay $4,500 just for the opportunity to pitch to an impact angel network. These stories are not uncommon, yet there is very little research on the funding challenges early-stage, for-profit purpose-driven enterprises in the U.S. face. In response, over the past year at Harvard University, I surveyed 60 companies to better understand the capital landscape and challenges facing entrepreneurs in this space.

The “Pioneer Gap”

When a purpose-driven business is in its startup phase, its ability to access seed capital is critical. Without that initial funding, promising startups cannot grow and realize their full potential. However, there are fewer documented exits in the purpose-driven entrepreneurship space, so funders gravitate towards later stage businesses where the risk of failure is significantly lower than the earlier stage.

[In] 2016, impact investors allocated only 4% of their available capital to seed and start-up stage businesses.

As a result, these businesses face a “pioneer gap” – a financial burden shouldered by new companies in their early stages of pioneering new business models for social change. According to JP Morgan and the Global Impact Investing Network (GIIN) Impact Investor Survey in 2016, impact investors allocated only 4% of their available capital to seed and start-up stage businesses. Similarly, on Enable Impact – an online platform connecting purpose-driven entrepreneurs and impact investors – the overwhelming majority (84%) of the for-profit, purpose-driven businesses in the U.S. are “early-stage”, but only 8% of all self-identified impact funders in the U.S. are interested in early-stage businesses.

“Eyeing Early Stage Business 8%: only 8% of all self-identified impact funders in the US are interested in early-stage business”.

Capital Landscape for Early-Stage Purpose-Driven Businesses

So, given the “pioneer gap”, how are purpose-driven entrepreneurs capitalizing their businesses at the earliest stages? My conversations and survey results reveal five key insights:

- Purpose-driven businesses choose a variety of legal structures

Company legal structure is important as it affects the ability of companies to access capital. The findings demonstrate that for-profit, purpose-driven businesses adopt a variety of legal structures. The most popular legal structures are C corporations (48%) and limited liability companies (25%). Interestingly, 12% of companies I surveyed are structured as public benefit corporations, a new legal denomination enabling companies to build “purpose” into their legal DNA. Given the variety of legal structures used by purpose-driven businesses, the “purpose-driven” label is a not a legal delineation

- Purpose-driven businesses raise less money than traditional technology startups

The size of seed fundraising rounds for purpose-driven businesses varies greatly. For the majority of companies (60%), the seed round is half a million dollars or less, with more than half raising less than $50,000. Only 14% of companies I surveyed have raised seed rounds of more than $1 million. In comparison, the average seed round for traditional technology startups is much larger – in the first half of 2016, the average size was $1.14 million.

- Friends and family are the top source of capital for purpose-driven businesses

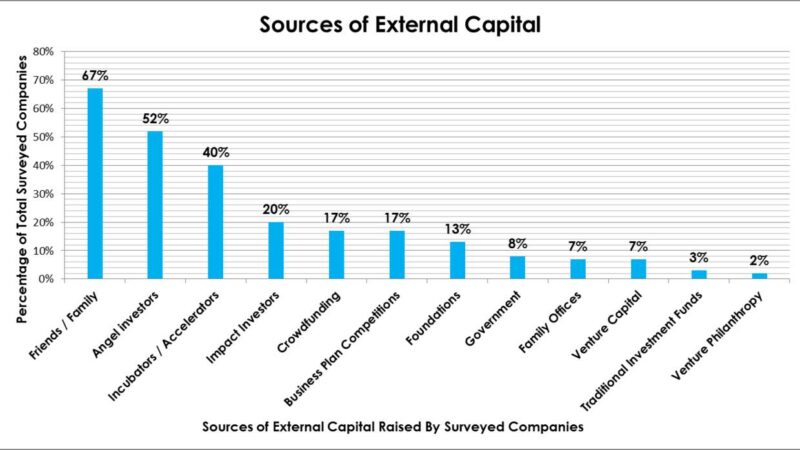

The companies I surveyed receive capital from 175 different sources – which fit in 12 main categories (see graph below). This diversity in funding sources is indicative of the democratization of seed funding and the lack of large institutional seed funders of purpose-driven businesses.

The three most common sources of external capital for purpose-driven businesses are friends and family (67%), angel investors (52%), and incubators and accelerators (40%).

Notably, despite the ascent of early-stage venture capital in the U.S. in recent decades, only 7% of purpose-driven businesses surveyed actually receive venture capital. Similarly, only 20% of companies receive capital from impact investors. Impact investors demonstrate a strong preference for investing in the later stages – certainly after commercial viability has been established and preferably once market conditions are well prepared for sustainable scaling.

- Convertible notes are the most common type of capital raised by purpose-driven businesses

The three most common types of capital raised by entrepreneurs to fund their businesses at the earliest stages are convertible notes (59%), equity (43%), and grants/donations (39%). Equity is almost three times more common than debt (16%). This result is not unanticipated, given the need among early-stage companies for longer-term capital without short-term repayment commitments.

- Purpose-driven businesses rely most heavily on networks

The three most common categories of resources used by purpose-driven businesses to identify and connect with potential funders are personal and professional networks (80%), incubator and accelerator networks (42%), and pitch and business plans competitions (38%). Less than 10% of companies I surveyed use impact investing intermediaries and platforms such as GIIN and Enable Impact to identify potential funders. These results demonstrate a significant reliance on networks as part of the fundraising process.

Want to know more about the difficulties purpose-driven businesses face during fundraising? Check out tomorrow’s blog to learn about the various challenges these businesses encounter in raising capital.

This blog post draws on original research conducted by May Samali and published in a Harvard Kennedy School Mossavar-Rahmani Center for Business and Government Associate Working Paper No. 59 titled ‘Mapping the Money: An Analysis of the Capital Landscape for Early-Stage, For-Profit, Social Enterprises in the United States’. Full citations for the data and statistics throughout this blog post are available online.

This article was originally published on Living Cities. Read the original article.

May Samali is passionate about investing in people and ideas that can change the world.

Share

We believe in open and honest access to knowledge.

We use a Creative Commons Attribution NoDerivatives licence for our articles and podcasts, so you can republish them for free, online or in print.