From Neo-Liberalism to Neo-Keynesianism

Having survived a near-death experience during the Global Financial Crisis, neo-liberalism now looks to be in a terminal state. While the new public policy order remains inchoate, a Keynesian ‘second coming’ does now loom as a distinct possibility.

Having survived a near-death experience during the Global Financial Crisis, neo-liberalism now looks to be in a terminal state. While the new public policy order remains inchoate, a Keynesian ‘second coming’ does now looms as a distinct possibility.

Deficit spending reminiscent of the heyday of Keynesianism in the 30 years after the end of World War Two is back with a vengeance. It is enough to make Keynes’ arch-rival and the ideological father-figure of monetarism and laissez-faire economics, Friedrich Hayek, turn in his grave! But the manner and magnitude of this turn to Keynesian reflation poses an inherent risk to the Keynesian aspiration to civilise market capitalism.

Affluent elites have a habit of using the state to assert their sectional interests, particularly when it comes to taxation and state power – and it would be naïve to assume that they are about to undergo a Damascene conversion to social altruism.

One of the burning public policy questions for liberal democracies like ours this decade will be how the tax burden associated with the ballooning public sector debt will be shared. Another – and closely related – question will be how the balance of political, economic and social power will change in a post-COVID-19 world. It’s high time for a wide-ranging and inclusive debate about the form and substance of the neo-Keynesian era before us.

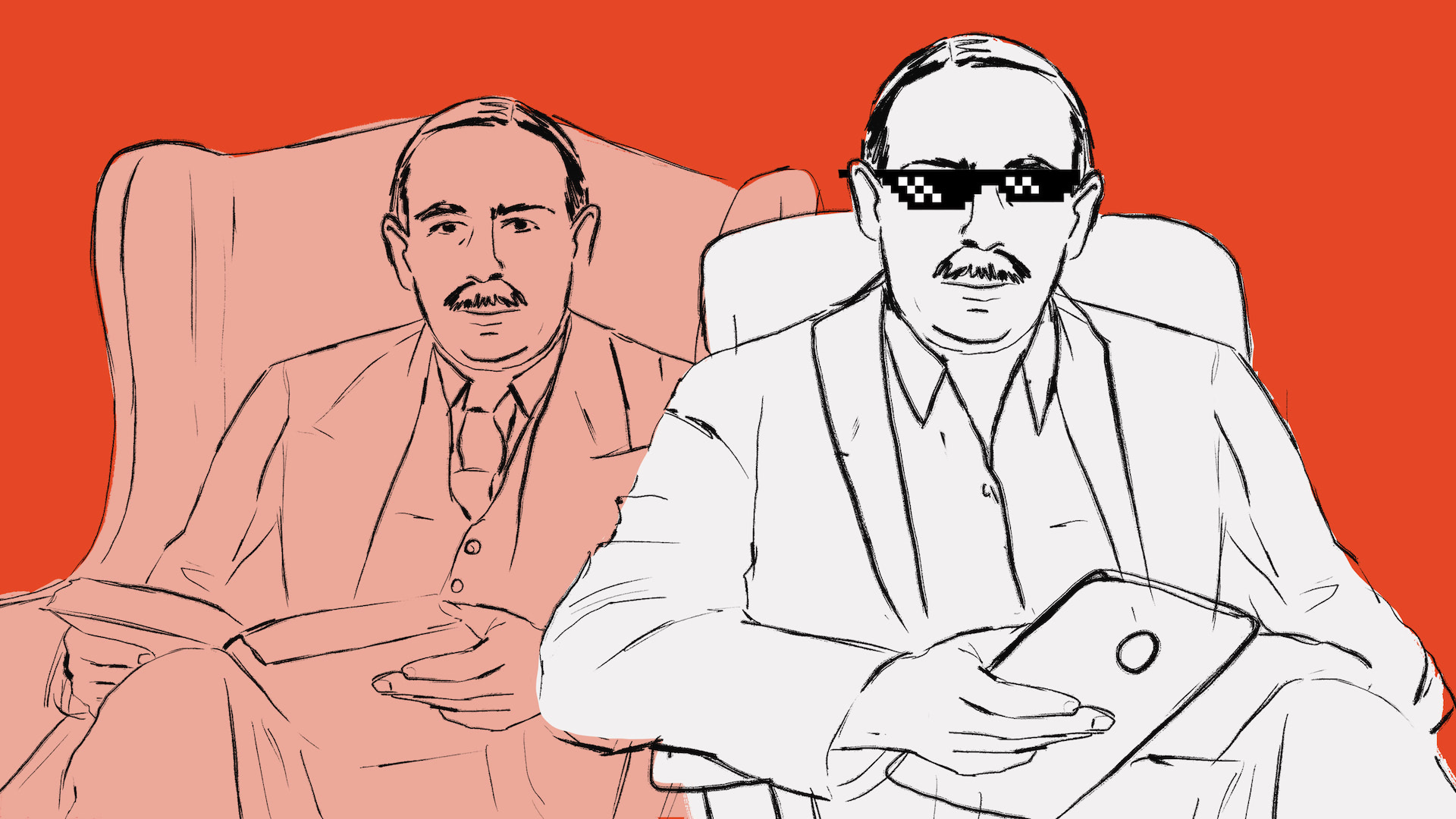

Given the dramatic turn of events since the new year began, I am now immersed in a reading reprise of the most influential (and in my view the best) of all economic theoreticians and public policy intellectuals of the twentieth century – John Maynard Keynes (1883-1946), and his clash of ideas with his principal intellectual rival, Austrian monetarist economist Friedrich Hayek (1899-1992).

The rivalry between Keynes and Hayek was certainly an epic intellectual battle – and it shaped the seismic swings in macroeconomic policy in western democracies long after Keynes’ death put an end to their terrestrial combat. To Keynes, fiscal policy held the answer to the cyclical ills of capitalism; to Hayek, the answer lay squarely with automatic interest rate adjustment and monetary policy more generally.

Current relevance of the battle of ideas

So what has this got to do with the here and now? Well, in my view, absolutely everything. Keynesianism dominated western macroeconomic theory and practice from 1945 (or perhaps from 1933 if you prefer to see FDR’s New Deal the war economy that followed as proto-Keynesian) until the advent of the scourge of stagflation in the mid-1970s; an economic malaise that seemed to vindicate Hayekian precepts and opened the way for what is now commonly termed the era of ‘neo-liberalism’ – of the dominance of monetarism, Reaganomics/Thatcherism, free-trade globalization, minimalist government, privatisation, the decline/dismantling of the welfare state (but not the warfare state), the bipartisan obsession with achieving budget surpluses, growing wealth inequality, etc.

Right now, we seem to be witnessing the death throes of the neo-liberal era (b.1975-d.2020). There is simply no more gas in the interest rate tank and ‘quantitative easing’ (i.e. printing money) is back on the agenda. And whilst the new order has yet to be born (to borrow a term from the Marxist phrase book) it is looking increasingly likely that, thanks to COVID-19, we are now at another inflection point in public policy in western democracies. Neo-liberals might be hoping for a ‘snap-back’ to the heydays of the 1980s and 1990s but this is prospect is becoming more remote by the day. The neo-liberal playbook has been trashed within just a few months and the economic relief measures introduced in Anglophone countries (including my own) look, for all the world, like the textbook Keynesian prescriptions for reflation that I first encountered in high school economics classes way back in the early 1970s.

There is next to no possibility of the unprecedented recourse to fiscal stimuli currently in train being reversed anytime soon. What a difference a disease makes! The ‘new normal’ or ‘new order’ will look very different to the neo-liberal disorder that has characterised the post-GFC decade and we may well be looking at the restoration of Keynesianism – or at least of Keynesianism 2.0.

A clear and present danger

But there is also a clear and present danger on the horizon – that of intensified nationalism, populism and authoritarianism in democratic countries like Italy, Spain, India, Indonesia, Brazil… and, yes, perhaps even the USA, UK and Australia. I hear intelligent people talk of the need for a ‘war economy’ to combat the current crisis in Australia – and I shudder. There is a very steep and slippery slope between curtailing freedom of movement to arrest the spread of a contagion and permanent control of civil society by authoritarian elites.

As I see it, a major challenge for democratic states this decade (additional to climate change, of course) will be how to institute a new Keynesian-style public policy agenda without overbalancing into authoritarianism. Time and time again we have seen wealthy elites capture the apparatus of the state to protect/advance their sectional interests. This is what happened in the west under neo-liberalism; it’s also what has happened in Russia under Putin and in China under Xi Jinping. Arguably, this is also what has been happening at an accelerated pace in the USA under Trump.

Don’t get me wrong, my admiration for Keynesian ideals remains strong. My worry is that, when the time comes to determine who will pick up the tax tab for public sector debt servicing, the rich will be no less motivated than they were in the neo-liberal era to protect their interests – and to do so aggressively. Remember how they and their media mouthpieces responded to the prospect of a mining tax! As any political economist worth her salt would say, how the Keynesian turn turns out will depend very much on how the power politics also plays out.

These are the reasons why I’m currently refreshing my understanding of the Keynesian 1.0 – its promise, potential limitations and possible perils. Given that the tide is turning, I would encourage others to do the same.

What I am reading

I am currently reading Penguin’s abridged (one volume, 2005) edition of Robert Skidelsky’s magisterial three volume biography of Keynes (1982, 1992, 2000). Another biographical work in similar vein that I’m currently reading is journalist Nicholas Wapshott’s admirably even-handed study of the clash of ideas between Keynes and Friedrich Hayek (1899-1992). Wapshott’s Keynes vs Hayek. The Clash that Shaped Modern Economics was first published by Norton in 2011.

This is part of a series of insights related to Coronavirus (COVID-19) and its impact on business.

John Shields is Academic Director International at The University of Sydney Business School and Professor of Human Resource Management and Organisational Studies.

Share

We believe in open and honest access to knowledge.

We use a Creative Commons Attribution NoDerivatives licence for our articles and podcasts, so you can republish them for free, online or in print.